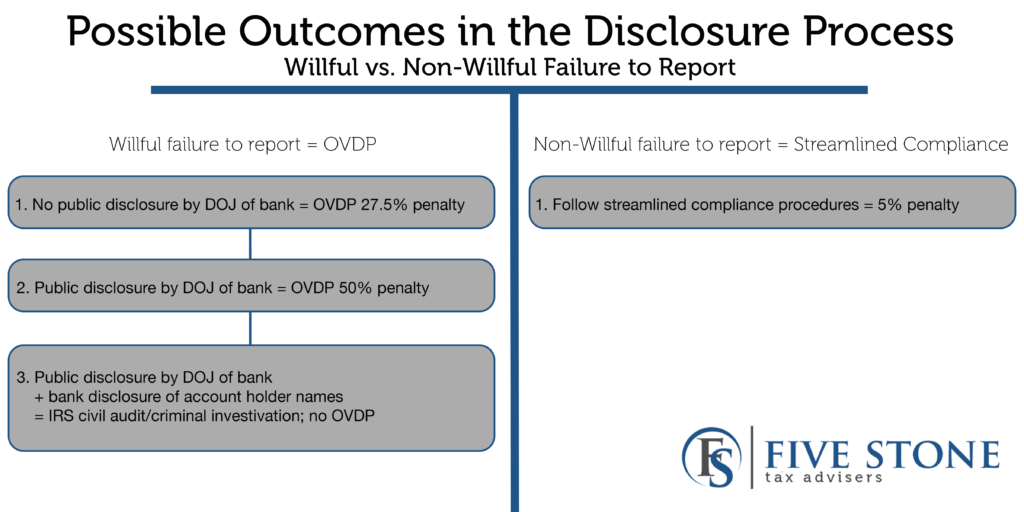

The deadline for Swiss banks to comply with the Department of Justice and turn over data regarding their U.S. account holders has passed. Next, the Department of Justice will begin the process of publicly disclosing banks under investigation.

Do Not Wait To Act; Time is of the Essence!

Public disclosure by the Department of Justice could occur at any time, so why wait? Do not rest easy simply because the deadline passed. If you are an American Citizen or have dual citizenship with the United States and have Swiss bank accounts that you failed to report to the IRS, the best thing you can do is consult with a tax attorney with an expertise in the Offshore Voluntary Disclosure Program and Streamline Compliance initiatives.

What is Non-Willful Failure to Report?

For many Americans working abroad, particularly U.S. expatriates and persons with dual citizenship, failure to report foreign bank accounts to the IRS has occurred due to a lack of knowledge of U.S. tax law. By way of edification, anyone with dual citizenship and everyone who files US tax returns and who has foreign financial accounts is required to file FBARs (Reports of Foreign Bank and Financial Accounts).

Taxpayers pursuing resolution of a foreign account issue within the streamlined procedures are required to certify under penalties of perjury that their conduct was “non-willful.” For purposes of the streamlined procedures, non-willful conduct is defined as conduct that is due to negligence, inadvertence, or mistake or conduct that is the result of a good faith misunderstanding of the requirements of the law.

Here is a non-exhaustive, brief example of what constitutes non-willful behavior:

- Taxpayer’s reliance upon the advice of a professional tax adviser who was informed of the existence of the foreign financial account;

- Legitimate purpose for establishing the unreported account;

- A lack of any intentional effort to conceal income or assets related to an unreported foreign account that was established for a legitimate purpose; and

- Small amount of tax owed related to an unreported foreign account.

If any or all of the following apply to you then you may be non-willful.

The IRS has recognized that many taxpayers fit this profile but have been afraid to come forward. In an effort to foster compliance, for a limited time, the IRS has expanded the scope of the Streamlined Filing Compliance Procedures (SFCP) to allow more people to access this program at a very small penalty. Once again, this expansion of the scope is temporary, and no one knows how long it will last, so now is the time to act.

Who Should Take Advantage of SFCP?

Any U.S. taxpayer with a foreign bank account in a Swiss bank that has had $10,000 or more who non-willfully failed to report foreign accounts to the IRS. It is important to note that this group includes Americans living abroad and individuals with dual citizenship, living anywhere in the world, with money in Swiss banks.

Some smaller Swiss Cantonal banks have yet to release their data to the IRS, but this is inevitable, and penalties are steep once the banks under investigation are announced.

We Can Help

If you are a U.S. person, including expatriates and dual citizens, with a Swiss bank account, you cannot afford to wait to contact a tax attorney with an expertise in the Offshore Voluntary Disclosure Program and Streamline Compliance initiatives.

Five Stone Tax Advisers has years of experience negotiating directly with the IRS to get the best possible outcome for you. Our International Tax Advisory and Compliance unit has a team of tax attorneys, certified public accountants and enrolled agents that form a single sourced point of contact that will provide services for all the legal, compliance and financial reconstruction aspects of these cases.

We are well-versed with IRS voluntary disclosure programs and the SFCP, and we want to serve your best interests. Don’t wait; contact us today.