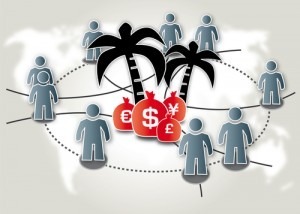

Domestic Companies Move Wealth Offshore for Lower Taxes

It is estimated that companies are storing wealth offshore, worldwide in an amount of approximately 2.1 trillion dollars and refusing to repatriate that wealth because of the high corporate tax rate imposed upon repatriation.